Capitalizing on Capitol Hill

September 30, 2022

THE IMMEDIATE AND LONGER-TERM IMPACT OF THE INFLATION REDUCTION ACT EXPLAINED

Davis HVAC Experts' high-efficiency heating and cooling systems offer a number of consumer benefits. From energy savings to comfort-enhancing innovations to quieter operation, there’s a lot to like. And now there’s another benefit, thanks to Uncle Sam: The Inflation Reduction Act of 2022.

WHAT IS THE INFLATION REDUCTION ACT OF 2022?

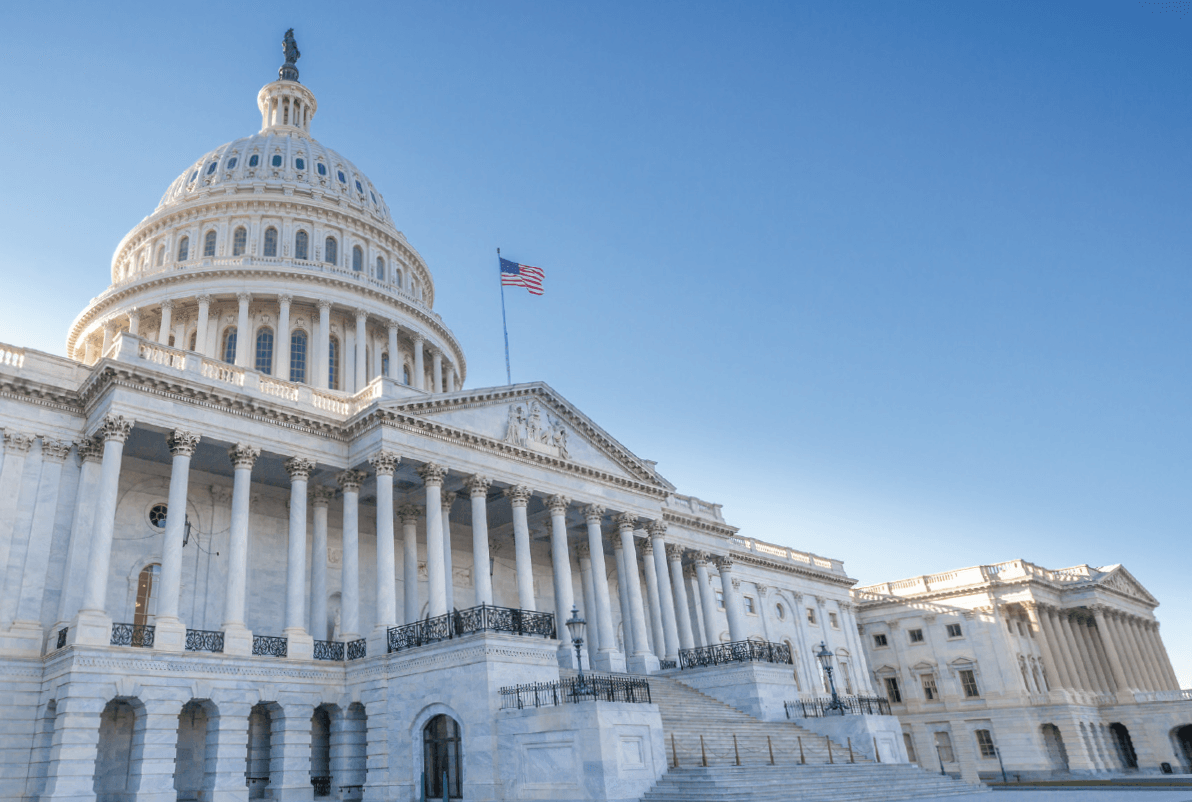

The U.S. Government has passed the Inflation Reduction Act of 2022, a piece of legislation covering a broad spectrum of initiatives, including health care costs, clean energy, and the federal deficit, among others.1 Of particular interest to homeowners, home builders, and HVAC contractors, this act includes a number of incentives for the installation of high-efficiency home heating and cooling products, including:

- $4.3 billion in state-administered rebates on ENERGY STAR® certified equipment

- Extension and expansion of 25C, 25D, and 45L tax credits for CEE Highest Efficiency and ENERGY STAR® certified equipment

Note: Rebate programs will take time to develop and will be subject to availability, and 25C tax credits available for 2022 will increase starting in 2023.2

This guide will take a closer look at rebates and tax credits, then offer some recommendations on using the Inflation Reduction Act of 2022 to choose the right Bryant high-efficiency systems.

THE REALITY ABOUT THE REBATES

While the $4.3 billion rebate budget certainly catches your eye, it’s best to be patient and attentive to details for now. Here’s why:

- Funds will be allocated to state energy offices with a fair amount of discretion on how they will be used.

- Depending upon the state, rebate programs may take some time to get implemented.

- Funding allocations will vary from state-to-state.

- The rebate program will not be available to all households. Households earning less than 80% of the median local income can qualify for the full benefit. Those earning between 80 – 150% of the average local median may be eligible for a partial (50%) benefit.

- Rebates will be subject to availability – the funds are capped, so they may run out before the ten-year period is over.

In contrast, the tax credits are in place now, and will continue to be available for the next decade.

TAKING ADVANTAGE OF THE INFLATION REDUCTION ACT TAX CREDITS: PATIENCE PAYS OFF

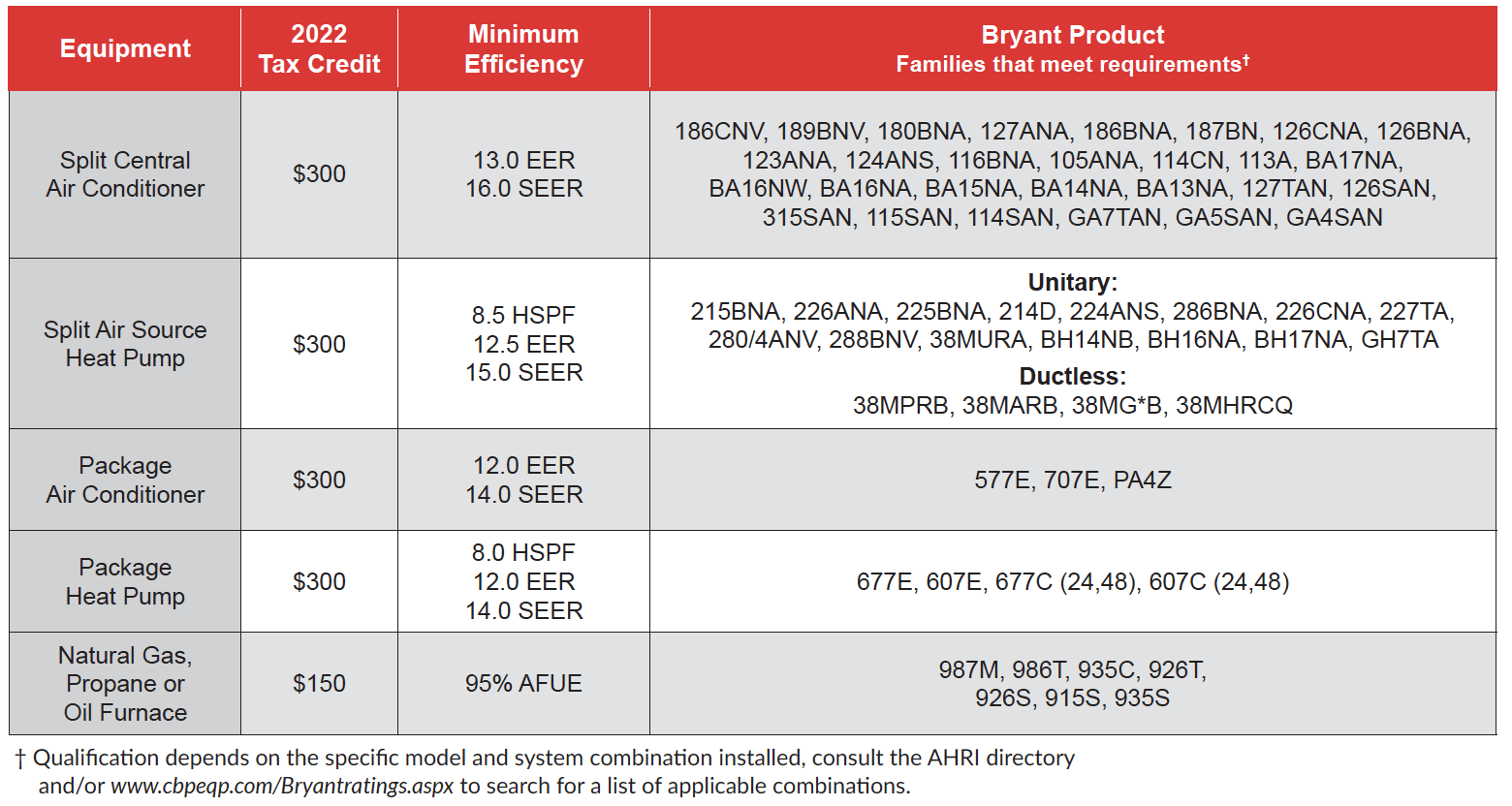

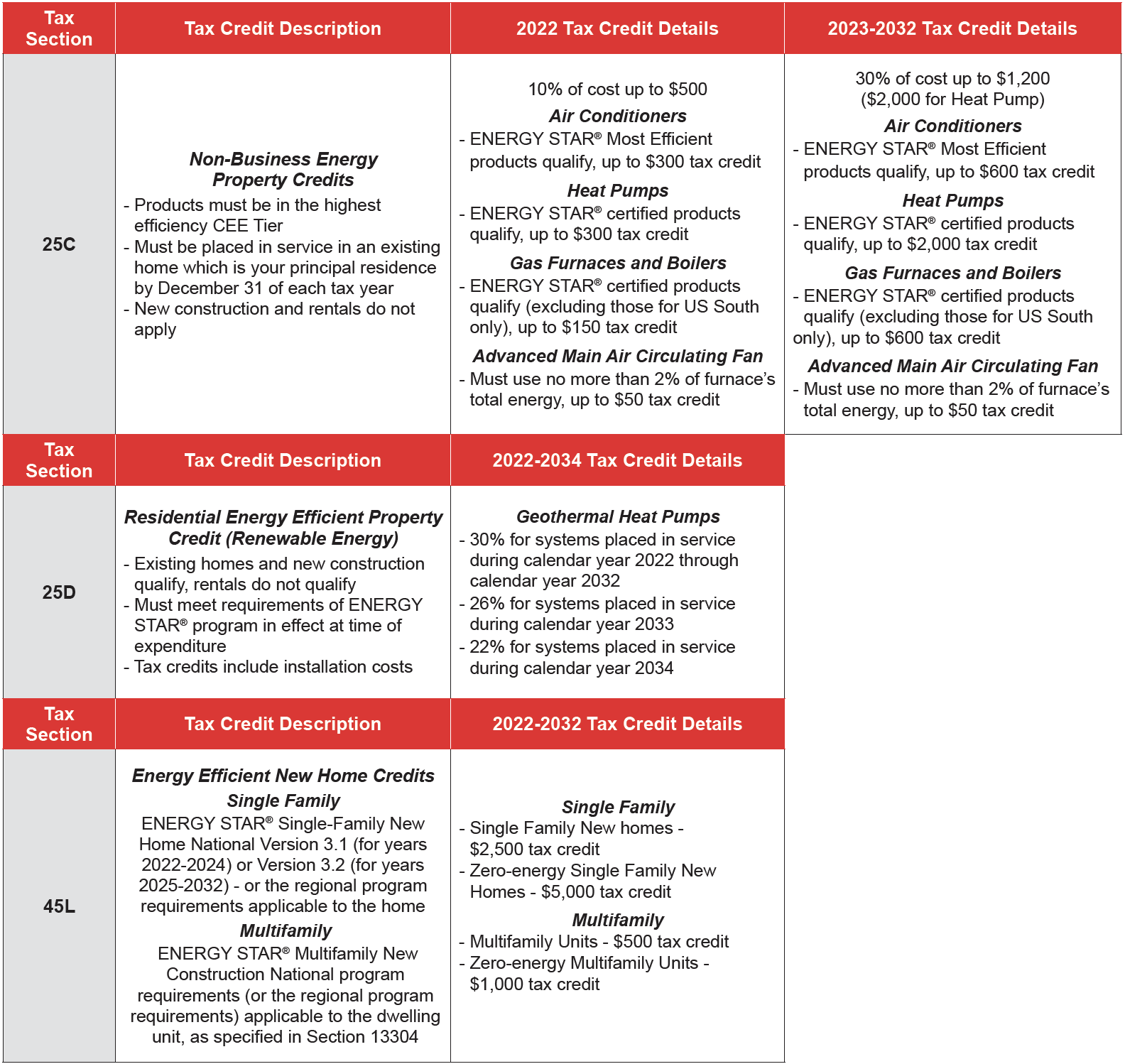

The Inflation Reduction Act of 2022 both extends and expands existing 25C and 25D tax credits to homeowners and 45L tax credits to home builders for installing applicable high-efficiency HVAC equipment. Each of these credits has specific efficiency requirements to qualify as outlined in the chart below. The bill applies to systems installed in 2022, and some of these credits will increase in 2023.

Here is a summary of the tax credits as they stand now, and for the coming years:3

WHEN DOES THIS NEW LEGISLATION TAKE EFFECT?

The Inflation Reduction Act of 2022 was passed by both the Senate and the House of Representatives and signed into law by President Biden in August of 2022. The current 25C, 25D and 45L tax credits apply retroactively to products installed beginning on January 1, 2022. As noted in the chart above, these tax credits will change again as of January 1, 2023.

HOW DOES THIS LEGISLATION AFFECT HOMEOWNERS?

For homeowners, this legislation makes stepping up to a higher efficiency home comfort system more affordable. And when they do, it can lead to higher satisfaction with systems that provide the additional comfort benefits of our premium products, including:

- Potentially reduced monthly heating and cooling costs with the highest efficiency models

- Evolution™ systemcommunicatingcapabilities• Multi-poise technology adaptable capacity comfort

- Perfect Humidity™ technology advanced moisture control

- Smooth, even variable-speed comfort

CURRENT PRODUCT ELIGIBLE FOR 25C, 25D, AND 45L TAX CREDITS

Davis HVAC Experts offers a comprehensive family of high-efficiency products that can help homeowners enjoy exceptional comfort, savings on their energy bills, and even receive some money back on their investment through tax credits and rebates. Here’s a look at products that meet the current efficiency requirements: